7 Rules for Surviving a Merger & Acquisition Technology Integration

There are many reasons why organizations turn to Mergers and Acquisitions (M&A’s) in today’s world, most important of which is increasing shareholder value either through growth opportunities in new markets, business diversification or product and service efficiencies.

However, the pace of innovation and digital transformation makes it increasingly hard on big organizations to tap into new markets and/or technologies outside of their core business without having the expertise to support such ‘disruptive’ initiatives.

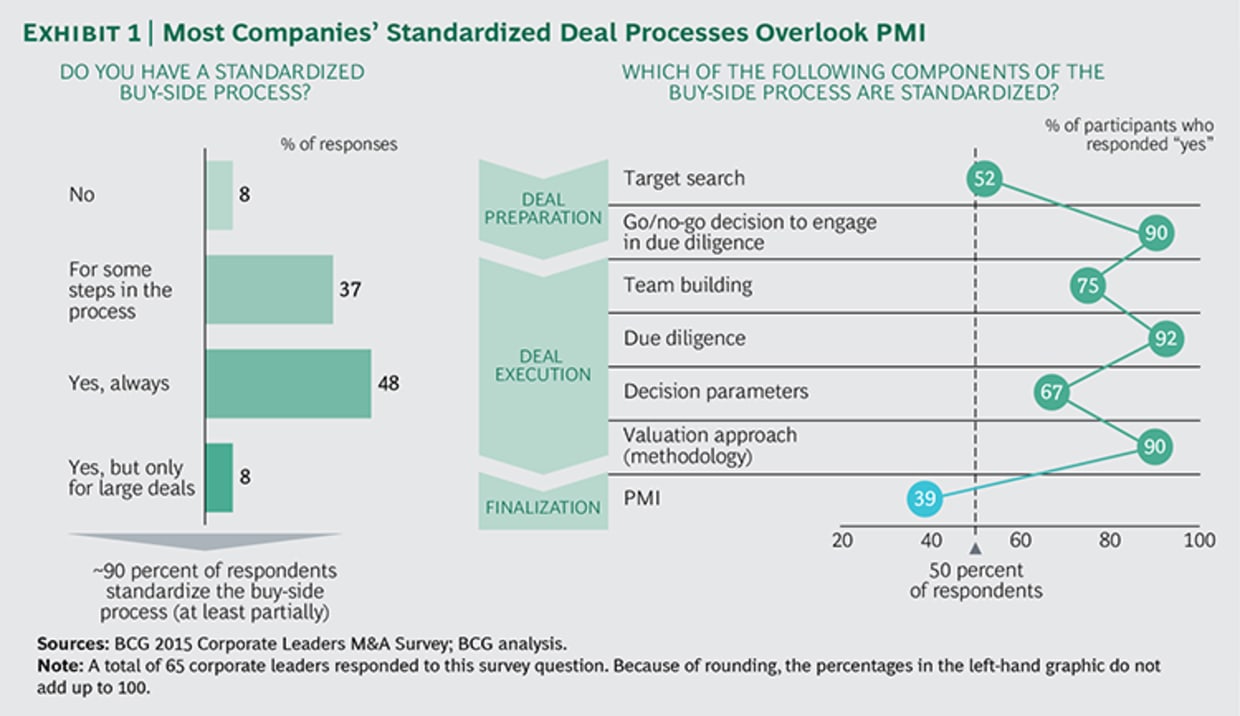

While tens of thousands of Mergers and Acquisitions take place every year, fewer Merger & Acquisition transactions are actually creating value. According to a BCG survey, only 47% of M&A deals produce positive results within the first year, and less than 40% of respondents have a standardized post-merger integration (PMI) plan in place to survive the often intense and stressful implementation phase.

At the end of the day, companies have to re-tool themselves post-M&A to align with the new business objectives and the new overall business strategy. An integral part of Post-Merger Integration (PMI) success is M&A IT integration. Successfully combining disparate approaches to IT and the M&A technology integration strategy to achieve this can make or break your PMI endeavours.

Having said that, M&A IT integration is one of the most challenging aspects of a merger. Every organization has its own data, technology, processes, and operations. Successful M&A IT integration requires very careful preparation, planning (even before the deal is struck) and deliberate follow-through to ensure execution is on track and, more importantly, in line with the post-M&A business strategy.

From our experience managing these transitions alongside clients for over twenty years, here are some guidelines that can help you navigate and overcome post-M&A IT integration challenges:

1. Gather Important Post Merger Integration Information in Advance

“Fail to prepare, prepare to fail,” as the old adage goes. And it very much applies to M&A technology integrations. If you wait until Day 1 post-merger to start the groundwork, then you’re already behind. Soon after an acquisition, IT leaders are under pressure to deliver on expectations to produce cost savings and enable synergies, and it’s ten times harder if they haven’t devised a clear strategy for M&A IT integration beforehand.

A better way is to rev up your M&A IT integration planning before the deal is sealed if at all possible. Engage trustworthy individuals from the IT leadership team to start planning the overall M&A technology integration strategy while the paperwork is being finalized so the team can get ready to hit the ground running.

It’s important to take the time to gather the information that will be relevant post-merger to better assess possible integration efforts so that when it’s time to make decisions, the facts are available to support the integration strategy. When you have all the facts and make no assumptions, you automatically reduce the risks to the M&A IT integration project.

2. Assess the Current State of IT Before M&A IT Integration Begins

Get a leg up before the M&A technology integration process starts. Recognizing that poor technology integration drains business value and may undermine the success of the overall Merger & Acquisition, get clear on the role of IT and the resources available from all parties involved, early on.

Take the time to audit and understand the merging company’s IT strategy, processes, and operations to determine how well they will mesh with the new system architecture and infrastructure. It’s no surprise that integrating multiple disparate systems, applications, and processes increase the complexity of an M&A technology integration.

Consider the current state of the existing infrastructure on both sides and define the goal of the future state before settling on the ideal approach to IT integration. The aim here is, of course, to reduce M&A IT integration complexity where possible.

M&A IT integrations are complex and require time and patience. No matter how experienced you are with M&A integration strategies, starting the IT integration process with an assessment of the current state can reduce the risk of IT failures post-merger.

3. Consider a ‘Best of Breed’ M&A Technology Integration Approach

Rather than “this is how we run things” or the “acquiring company is always right”, seize the opportunity to evaluate the emerging needs of the newly combined IT department. If you notice the acquired company’s IT infrastructure is one of its strong suits, then be open to choosing the best available IT setup that aligns with the future direction and IT goals of the organization as a whole.

One caveat. It’s vital to foster relationships with your new business partners across the merged organization to have a clear, shared vision of what “best of breed” means for the organization. If you feel this could turn into political warfare, then (where possible) engage third-party consultants to undergo objective assessments to determine the optimal integration approach to avoid getting sidetracked.

Post-Merger IT Integrations can be a great opportunity to challenge the status quo and embrace change, enhancing processes and technology for the organization as a whole. Remember: the rule of thumb here is to enable synergies while reducing complexity to minimize disruption where possible.

Get in touch today to see how Steeves and Associates can help you achieve success with your M&A technology integration!

4. Pre-Merger & Acquisition Due Diligence is Critical

When an acquisition is planned, companies tend to focus more on preparing and finalizing the deal rather than figuring out how to best manage the integration when the deal is done. BCG’s M&A Survey examines post-merger integration failure, and interesting enough, half of the respondents named “high complexity, poor integration, and low synergies,” as some of the biggest reasons for integration failure.

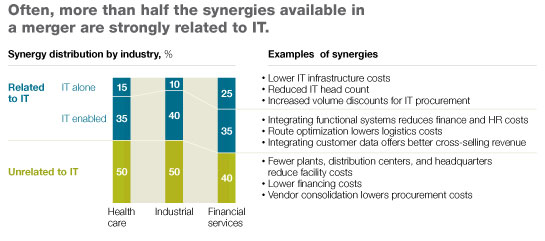

A fairly common strategic mistake in the due diligence process is to overlook the role of IT. According to McKinsey, merging companies often struggle with unrealistic post-merger integration expectations and inflated anticipated synergies due to a lack of understanding of the strategic value of IT in M&A.

Rather than signing the deal and hoping for the best, why not proactively assess your target company’s technology infrastructure and capabilities? Getting your IT leadership on the table to size up the integration efforts and flag potential integration obstacles cannot be overestimated.

This way, IT not only provides valuable input on the post-merger IT integration roadmap and change management but also sets realistic expectations for future synergies and potential cost savings.

5. Integrate Your IT Groups Quickly, No Stragglers or Distractors

The first 100 days are critical to your technology integration project success. That said, don’t waste time trying to eat the elephant (or fix everything all at once). Managing M&A technology integration mandates a comprehensive, phased approach that tackles both long-term and (even more importantly) immediate short-term needs. There is no point focusing on a long-term IT transformation when you don’t have a plan to keep the “lights on” from Day 1.

Agile Project Management for a Successful M&A Technology Integration

Adopting an agile approach to project management helps to execute tasks in phases at a steady pace to reduce project complexity and risk. Prioritize the integration projects and break them down into a set of requirements, then focus your efforts on the short-term milestones and deliverables. This way you deliver phased and scalable IT solutions for immediate needs that are tied to your new business drivers.

6. Rebrand Externally but Plan Internally

Your potential brand equity from the new merger is tied to your post-merger integration results. A failed IT integration results in inefficient processes, poor productivity and increased operating costs, which negatively impacts your new brand and puts your customers at risk. Take note, McKinsey & Company estimates that more than 50 percent of post-merger synergies are IT-related.

Managing a successful Integration is instrumental for living up to the potential of your new brand equity. With that in mind, take the time to get all your ducks in a row. PLAN to understand, communicate and define your integration goals internally.

Understand the scope and complexity of the M&A technology integration and proactively work with business leaders to define the merger & acquisition goals. Think big but focus on short-term planning first. Aspiring for long-term value transformation is great, but that doesn’t mean much if there’s no plan for what to do in the short-term.

Don’t try to work on the process and implementation overhaul from Day 1. Your top priority for the first 100 days should be business continuity and maintaining business operations to reduce the integration risks post-merger. Once overall goals are identified, you’re ready to move on to the next step of planning your M&A Integration strategy.

7. Planning your M&A Integration Strategy Takes as long as Implementation

Planning the post-merger integration strategy is complex and requires care. Take the time to plan your strategy well ahead, as sometimes it can take as long as the actual implementation. Ushering in everything you learned thus far, frame your technology integration strategy around people, processes and technology.

1. People

Everything starts with people. It’s very important to lock down the right organizational structure. Start by outlining your key resources, skill sets, and readiness and, if necessary, build the new organization.

Plan your capacity and staffing needs either through retaining your top talent or hiring the right people in the right roles for the future state of the new IT organization. Having the right team in place mitigates post-merger integration risks.

2. Processes

Your Enterprise IT impacts of all your business processes. So, where do you start?

Start with a map of the current landscape. As you’re trying to enable new processes and maximize synergies, map out the current processes of each organization. Take stock of the systems in place, what processes they support and why? Analyze the interdependencies of existing processes, examine whether they should be kept, enhanced or replaced, and evaluate how they affect your post-merger business functions.

The goal is not only to document processes but also to develop an understanding of how one process-change may impact other lines of business. Your goal is to capture the combined business capabilities and requirements and prioritize them for your IT integration plan.

Take heed. The M&A IT integration plan is your north star. It helps you to optimize the integration process with as little disruption as possible in the short to medium-term, but more importantly, it drives long-term business value in line with the post-M&A business strategy.

3. Technology

Having mapped out the scope of the integration from a process point of view, you’re in good shape to tackle the HOW. At this point, there should be a thorough understanding of the two technology stacks, integration challenges, functional gaps, and mission-critical applications. This information is key for making decisions about the new IT architecture, such as which systems to migrate and which legacy systems to leave behind.

This is where your Infrastructure Optimization (IO) strategy comes into play. Savvy IT integration managers will leverage Infrastructure optimization best practices such as simplification, standardization, virtualization and consolidation to reduce integration complexity, redundancy and deployment time.

Prioritizing portfolio rationalization is a key step in your Infrastructure Optimization efforts. It’s imperative to undergo a diligent portfolio rationalization that includes data, infrastructure, and business applications – to better manage the cost, risk and time of the integration process.

An early conversation around people, processes, and technology is pivotal. It gets you in a prime position to better understand the overall picture and how to tackle the integration project with a comprehensive approach from Day 1.

Ready to Achieve M&A IT Integration Success?

IT is instrumental to post-merger integration success. Yet, IT integration in mergers and acquisitions can be very challenging, especially if there is no vision guiding the execution.

A successful post-merger technology integration strategy requires a thorough analysis of the current state of IT at each organization as well as the ideal future state. The right integration strategy always hinges on cost-effective and optimized architecture. This is only achievable with a clear understanding of the new business requirements, harnessing the right people, processes and technology.

Companies don’t have to learn and develop this expertise on their own. Technology partners with specific M&A experience can greatly help and support organizations in comfortably maneuvering such a high-stake situation. Make sure to leverage the necessary expertise and best practice approach for developing an IT integration strategy that lays the groundwork for both short-term operational consolidation and long-term business growth.

Get in touch If you’re interested to learn how Steeves and Associates can help you to support, plan and execute your post-M&A business objectives. With so many years of experience in infrastructure rationalization and Enterprise IT integration under our belt, we’ve helped many organizations with their M&A architecture and infrastructure shifts.

Author Bio: Dave Steeves

Dave Steeves, CEO and Founder of Steeves and Associates, has been on the cutting edge of technology throughout his career with the past 25 years running his own company as Microsoft 1st Canadian Cloud Partner and one of the first Microsoft Certified Partners. Steeves has always been an early adopter and visionary, helping his clients adopt disruptive emerging technologies managing risk with careful selection of viable use cases to create value. When not tinkering in tech Dave enjoys hockey, skiing, and spending time with his family.